How to Set Clear Terms That Will Get You Paid

You can be the best designer or developer in the world, but if you don’t know how to invoice, you’re going to have problems getting paid on time — or at all.

The best way to get paid on time is to be extremely clear with clients about payment terms. When is payment due? How are they going to pay you? What is the penalty if they are late? Setting clear payment terms will alleviate a lot of frustration for you and your clients.

Here are three steps to setting clear payment terms.

1. Set Your Terms

Before you can make payment terms clear to clients, they need to be clear to you. If you think all invoices are created equal, you are mistaken. Some invoices ask to be paid within 45 days (clients happily set those aside). Some invoices ask to be paid immediately (clients begrudgingly set these aside, too). Some invoices threaten penalties if they aren’t paid on time. The list goes on.

Deciding the perfect set of terms takes some nuance, and much of it can depend on your niche. In general, you’ll want to decide the following.

Payment Due Dates:

With Postcards Email Builder you can create and edit email templates online without any coding skills! Includes more than 100 components to help you create custom emails templates faster than ever before.

Free Email BuilderFree Email TemplatesAfter much trial and error, we’ve discovered that requiring payments to be due within 15 days will get you paid on time much more often than “Payment due upon receipt,” and obviously much faster than “Payment due within 45 days.”

It also helps to include the actual due date on invoices. For example, “Payment due 15 days from the date of this invoice. Please pay by March 23, 2015.”

Payment Type:

How would you like clients to pay you? While a check often a default method, it is not the only method. For some clients, electronic payments will create far less friction and allow them to pay invoices immediately. Whichever method you prefer, make sure invoices provide all the information necessary for clients to make payments.

If you take credit cards, offer a URL where they can make the payment. If you take checks, let them know to whom the check should be made out. If you accept ACH transactions, include the necessary bank information. Everything your client needs to make a payment should be right on the invoice.

Late Payment Penalties:

You have the option of charging a penalty if clients fail to pay on time. The most common fee structure is 1.5 percent fee starting 30 days past due. While it is nice to have this leverage, actually enforcing these fees can be a hassle. It’s also a good idea to check with an attorney before including these, as laws about interest rates vary from state to state.

With Startup App and Slides App you can build unlimited websites using the online website editor which includes ready-made designed and coded elements, templates and themes.

Try Startup App Try Slides AppOther ProductsWe’ll cover more about late fees below, but for now you simply need to decide whether or not to adopt them, and then be sure they are laid out clearly on your invoices.

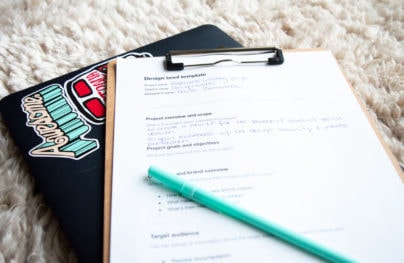

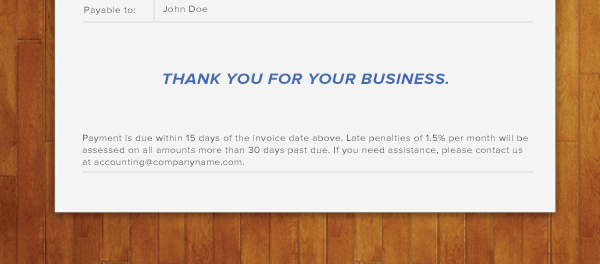

Keeping all of the above in mind, here is an example of what effective payment terms might look like:

Please make all checks payable to {name}.

Thank you for your business. Payment is due within 15 days of the invoice date above. Late penalties of 1.5% per month will be assessed on all amounts more than 30 days past due. If you need assistance, please contact us at accounting@company.com.

2. Confirm Terms With the Client

This step can make all the difference when it comes to getting paid on time.

A few days after you’ve sent an invoice to a client, give that client a call. Tell them you want to confirm that they received your invoice and make sure everything looks okay. Call attention to your terms (due date, payment type, late penalties) and make sure they’ve noted them as well. Most clients won’t take a very close look at invoice unless you walk them through it.

This phone call is a great opportunity to solve problems before the bill goes past due. Is the invoice for the agreed-upon amount? Do they have all the information they need to send the payment? Treat this call as a customer service call, but at the same time clearly communicate terms and putting your invoice at the front of their mind. Don’t be surprised when your check shows up a few days early.

3. Use Late Payment Penalties to Your Advantage

If you decide to include late payment penalties on invoices, consider using them in a nontraditional way. Sure, you could enforce them rigidly, issue penalty invoices, etc. But most times issuing another invoice isn’t going to help you get your first invoice paid. Not to mention it puts you and your client at odds and could seriously damage the relationship.

Instead, use the late payment penalty as a bargaining chip. When a payment goes 30 days past due, kindly remind the client of your late payment policy, but offer to waive the fee if they’re able to get a check in the mail that same day. Not only will this give them extra motivation to pay you, but they’ll also feel like you’ve done them a favor. Not a bad place to be with a client.

Whatever you decide your terms should be, the most important thing is to strive for clarity. Make sure everyone is on the same page. Make sure the terms are easily readable on your invoices, simple to understand and leave little room for interpretation. Clear, strong terms will make things easier on you, your clients and your bottom line.