Critical Email Types for Financial Services

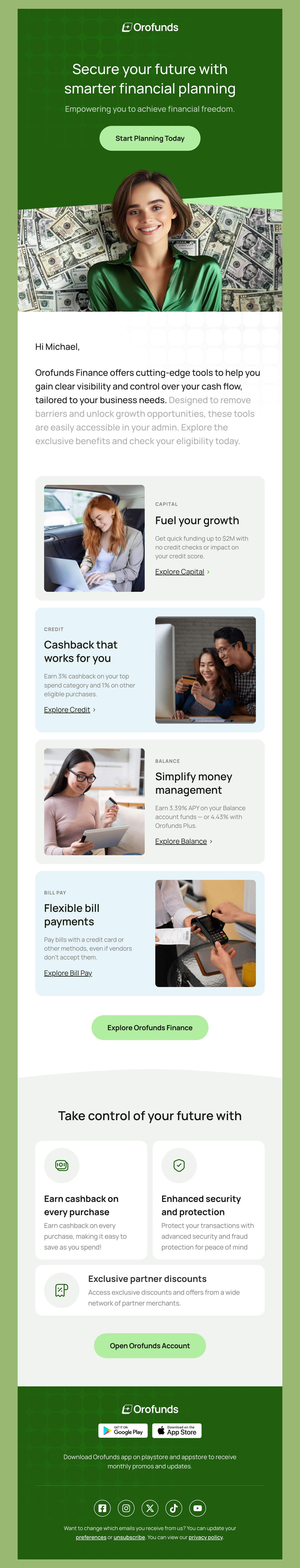

In the finance industry, trust and clarity aren't optional; they're essential. Every email you send either builds confidence or raises doubts. Strategic email communication helps you educate clients, simplify complex information, and maintain the transparency that modern customers demand.

Here's how different email types serve your financial communications strategy.

Account Alerts & Notifications: Timely notifications keep clients informed and secure. Clear, immediate email communication about account activity demonstrates you're actively protecting their interests while keeping them in control of their finances.

Financial Education Series: Complex financial concepts intimidate many people. Educational emails that break down topics like retirement planning, tax strategies, investment basics, or credit management position you as a trusted advisor rather than just a service provider. When you help clients make smarter financial decisions, you become indispensable to their financial journey.

Statement & Report Delivery: Monthly statements, quarterly reports, and annual summaries need to be more than just data dumps. Present financial information in digestible formats with clear visualizations, highlighted key metrics, and actionable insights.

Regulatory & Compliance Updates: Financial regulations change constantly, affecting how clients should manage their money. Proactive emails about policy changes, new compliance requirements, or regulatory updates show you're staying ahead on their behalf.

Best Tips for Financial Email Marketing

Financial emails require a delicate balance between engagement and compliance. Here's how to communicate effectively while maintaining trust.

Prioritize Security & Compliance: Every financial email must meet strict regulatory standards. Include required disclosures, maintain proper documentation, protect sensitive information, and follow industry regulations like GDPR, FINRA, or SEC guidelines. Build email templates with compliance built in, so you never have to worry about missing critical legal language or required disclaimers.

Build Trust Through Transparency: Avoid jargon and fine print tricks that erode confidence. When clients feel you're being straightforward, even about uncomfortable topics, they trust you with bigger decisions and longer relationships.

Segment by Financial Goals: Not all clients have the same needs. A young professional saving for their first home has different concerns than someone planning retirement. Segment your audience by life stage, financial goals, account type, or investment strategy. Tailored messages that address specific situations get far more engagement than generic financial advice.

Use Data Visualization: Numbers alone overwhelm people. Transform complex financial data into clear charts, graphs, and infographics that make trends instantly understandable. When people can see their financial picture clearly, they make better decisions and feel more confident.

These approaches help you cut through the noise in crowded inboxes while building the long-term relationships that define successful financial services.